Market Conditions

After the sell off on Tuesday, we’ve essentially come full circle on the week with the S&P almost unchanged. Indeed, we have a similar cup/handle forming, targeting the 2742 range, along with and inverse head & shoulders pattern. The sell-off found support around 2615, and we have a series of higher lows being established going back to March. That being said, we’re not seeing the momentum to lift us through resistance yet, and continue to chop around here during earnings season.

In terms of earnings season, the average stock has fallen in price on it’s earnings reaction day.

Watchlists

On our 2018 watchlist we have two target captures this week – MPC, and DPZ. MPC remains in motion still targeting higher levels, while DPZ hit it it’s second target and is consolidating the recent earnings reaction gains.

On the 2018 watchlist, 51% of plays are currently positive on the year. The best play is ABCD, which is up 33%, followed by USNA which is up 21%. While the worst is CG -20%, followed by VEDL -18%.

We added UFCS, and MNTA to our watchlist this past week.

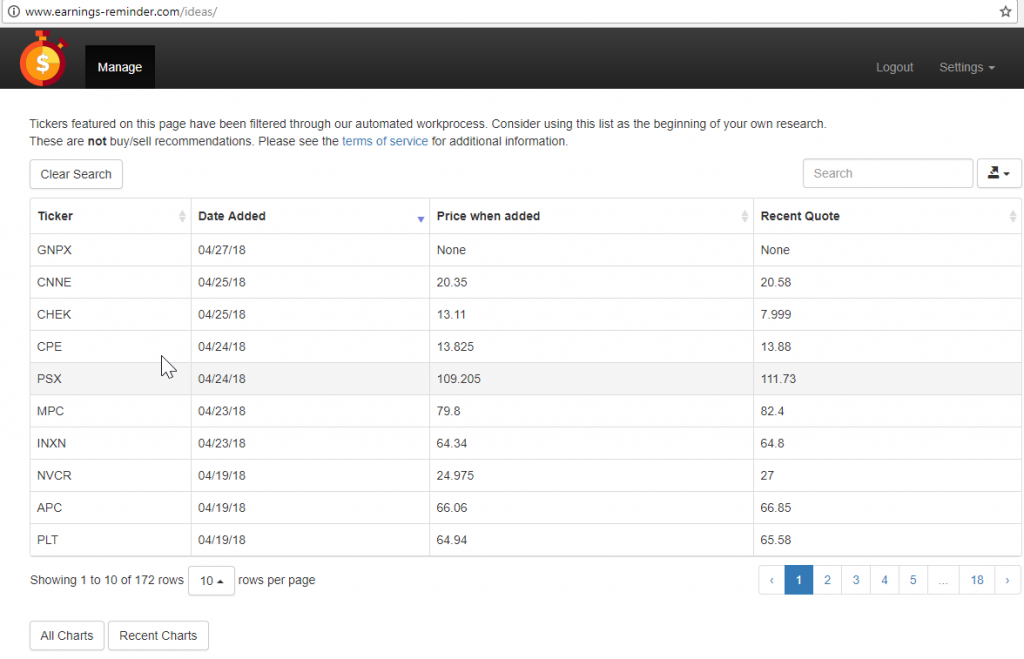

The idea generator had 7 new signals to review, including GNPX, CNNE, CHEK, CPE, PSX, INXN, and MPC (one of this week’s watchlist target captures.)

Showing up on this week’s radar, we have CNNE, FFKT, I, SYBT, LULU, PLT, and MPC (again).

The model portfolio continues to outperform the S&P over the same time period, with the model being up 7.19% vs. 2.37% on the S&P.

Other

In terms of sector performance, utilities, healthcare, and services are all green on the week. While industrial goods, conglomerates, and tech lost ground.

Fear levels continue to lessen, moving from 38 to 40 in the past week.

The big winners on the week include GNPX, EVGBC, CHEK, EBIO, LEDS, CRK, EYPT, TZOO while the biggest losers include PRTA, CHKE, ERN, WLB, INPX, RKDA, FTK, CLW.