Since the introduction of the idea generator, we’ve observed the following win-rates: 4th Quarter, 62.94% December, 54.84% November, 62.94% Since inception (8/17) the idea generator has win rate of 61.17%. Performance My personal watchlist that I share on the site has seen a winrate of 71.43%, while my trading account reflects an approximate return ofRead More

Month: December 2017

Week 51 Watchlist Additions

I didn’t add any symbols to the watchlist this week, but we have 14 new signals in the idea generator on 12 different symbols … RIOT,ARE,ATGE,BBY,EC,FLOW,RIOT,BFR,CVI,DGRW,RIOT,ENTA,IHG,MGEN for review. All of which were all posted to the idea generator for our members to consider earlier in the week. Unsurprisingly RIOT showed up more than once, but youRead More

Bug Fix: Ex-Dividend Dates

We received a report yesterday, that for one valid symbol there was no ex-dividend date information being returned. After investigating the symptoms, we were able to reproduce the symptom on the symbol in question and have since resolved the issue. Afterward, we re-ran our ex-dividend maintenance against all symbols currently being tracked at Earnings-Reminder, andRead More

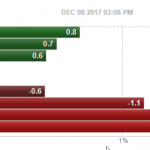

Week 50 Watchlist Additions

I added CR, and D to my watchlist this week. Of note, the prior week’s watchlist additions have shown quite a bit of strength since being added, with idea generator additions from week 49 also faring favorably. This week, the idea generator saw 5 new additions with NEWT, VNET, VRX, HCC, and ETSY being added. Looking atRead More

Week 49 Watchlist Additions

During the past week, I added ESNT, L, PRA, MEOH to my watchlist, with 8 new symbols on the idea generator CACC, FIVE, ERI, DVY, RIOT, FNDC, AHH, XNET. The following have been on my radar of late… ERI, FCFS, FII, BGC, BXMT, ITRI, LE, SCMP, WDAY. The S&P is down a bit on the week, openingRead More

New Report: Trade-to Target Capture Notifications

Now that we have the weekly watchlist summary report completed, it makes sense to add the trade-to target capture notification report, since the two are closely related. The purpose of the trade-to capture notification report is to alert you whenever a trade-to target that you’ve set on one of your watchlists has been captured. This mightRead More

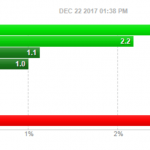

Idea Generator Win-Rate Check-In, Q4 2017

As a follow-up to the Q3 Review of the the idea generator and it’s Q3 performance, I wanted to do a quick check-in on the win-rate to see how the tool is faring here at the beginning of December. No matter how I slice the data, the win-rate has remained consistently above 60%. Of course, thisRead More

Sample Model Portfolio Ideas

One of the things that I’ve been interested in doing is building a semi-diversified model portfolio, based solely on the output of my Earnings-Reminder watchlists and workflow. And I want to be able to measure it against the real-world S&P performance… and do so without adding anything to my work process beyond what’s available on theRead More

Week 48 Watchlist Additions

I added SF, VMI, and GMS to my watchlist this week, which generally reflects the sector action. In similar fashion, I have 18 symbols frequenting my radar of late the are due for some further review… BSM, NUAN, SCMP, ALDW, ARKK, ARKW, AWI, BECN, BLDR, CDK, CRI, DE, DHI, DK, DON, DQ, FCFS, FOR. Turning to theRead More